GovSpend Review (2025): High-Risk GovTech Intelligence Tool?

In the sprawling, often labyrinthine world of U.S. government contracting, data is king. This review cuts through the marketing to reveal the strategic DNA, technological efficacy, and contractual realities of GovSpend, providing a definitive verdict on who should—and, more importantly, who shouldn’t—invest in this powerful but paradoxical platform.

The Private Equity Playbook: Understanding GovSpend’s DNA

To truly understand GovSpend’s behavior in the marketplace — its pricing, its contracts, its strategic decisions — one must look beyond product features and examine ownership. The most significant event in the company’s history occurred in January 2021, when it was acquired by Thompson Street Capital Partners (TSCP), a St. Louis-based private equity firm. This transaction transformed GovSpend from a founder-led company to a PE-controlled asset, and fundamentally changed its operational mandate.

Private equity firms work according to a clear model: they acquire a company with great potential, professionalize it, accelerate its growth to maximize its valuation, and exit the investment within a few years with a substantial profit. The key metric in this model, especially for a software-as-a-service (SaaS) company like GovSpend, is annual recurring revenue (ARR). Every strategic decision made after the acquisition is usually considered from the perspective of how it can protect and increase ARR.

This influence is most clearly felt by customers in the company’s business practices. The opaque, individual pricing model is designed to maximize the initial contract value. More critically, the notoriously rigid and customer-unfriendly contract terms are a direct result of the PE focus on ARR. User reviews contain numerous complaints about binding multi-year contracts, a strict termination and refund policy, and controversial automatic renewal clauses.

This is not bad customer service, but a deliberate financial strategy. This categorizes GovSpend as a “PE-driven market aggregator” — a company that primarily deploys capital to consolidate data and market share, and whose business practices are focused on financial growth rather than customer-centric flexibility.

A Tale of Two Platforms: SLED vs. Federal Capabilities

GovSpend’s market offering is not a single, monolithic platform, but a two-part solution that has emerged from the company’s history and acquisition strategy. This two-platform approach makes it possible to cover the entire US public sector, but potential users need to understand the different origins and relative strengths of each component.

The GovSpend Platform (SLED): The Core Engine

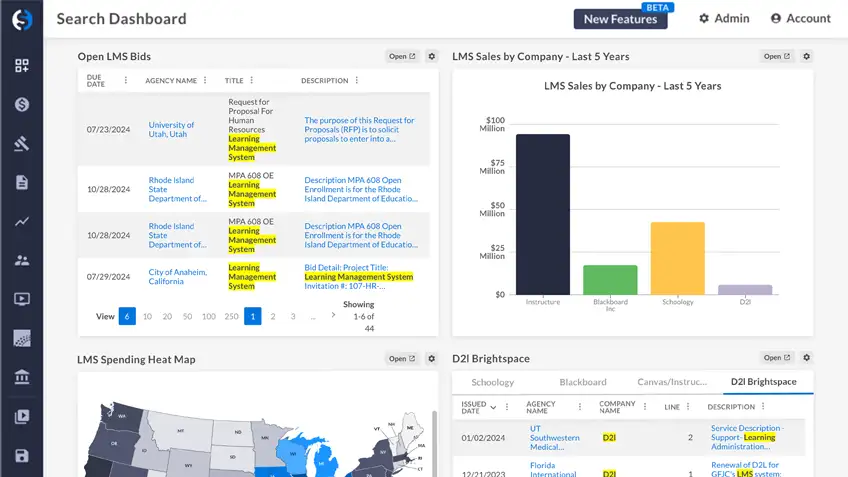

The company’s flagship product is the GovSpend platform, which targets the state, local government and education (SLED) markets. The company’s unique value proposition is the ability to uncover the “critical 80% that often remains hidden” This refers to the vast amount of government spending that occurs outside of the formal, public bidding process, such as discretionary purchases with procurement cards (P-cards) or spending under pre-approved cooperative agreements.

The Fedmine Platform (Federal): The Bolted-On Acquisition

GovSpend’s solution for the federal market is the Fedmine platform, which was acquired in 2021. Fedmine was a long-standing and respected player in the federal data processing space, known for its powerful engine that merges and integrates data from 19 different federal sources such as SAM.gov and the Federal Procurement Data System (FPDS). The acquisition was a brilliant strategic move that immediately gave GovSpend a credible offering at the federal level. However, it is important to see GovSpend for what it is: a “bolt-on” function.

The User Experience Paradox: Simple Interface, Complicated Results

Perhaps the most polarizing aspect of GovSpend is the stark contrast between its user interface and the results it generates. The platform is almost universally praised for its design, yet simultaneously criticized for the quality of its data.

On one hand, GovSpend has solved one of the biggest problems in the GovTech information market: usability. In the user ratings on G2, GovSpend scores 9.1 out of 10 for “ease of use” On the other hand, a beautiful interface is worthless if the underlying data is flawed. A large proportion of users complain about serious problems with data quality, which directly undermines the platform’s value proposition. Most complaints relate to the fact that the platform does not deliver tangible business results.

The Achilles’ Heel: A Glaring Security and Compliance Gap

In the world of government technology, security and accessibility are not optional features, but fundamental, non-negotiable requirements. A thorough investigation reveals a shocking and profound flaw in this area: there is no evidence that the company has the usual government-mandated certifications.

Our research found no mention of:

- SOC 2 or ISO 27001: Standard third-party attestations of a company’s information security controls.

- FedRAMP (Federal Risk and Authorization Management Program): A mandatory security authorization for any cloud provider selling to U.S. federal agencies.

- StateRAMP: An increasingly adopted security framework for vendors selling to state and local governments.

- Section 508 / WCAG: A federal law requiring that technology procured by the government be accessible to people with disabilities.

This compliance gap effectively renders the platform a non-starter for a huge portion of its intended government agency market. It calls into question the seriousness of their go-to-market strategy for the public sector itself and represents an extreme compliance risk for any government entity that might consider the platform.

The Bottom Line: Cost, Contracts, and a Highly Variable ROI

Ultimately, the decision to invest in a platform like GovSpend boils down to a cost-benefit calculation. The company’s pricing is completely opaque. The only concrete data comes from the SaaS procurement platform Vendr, which states an average annual cost of USD 10,000, ranging from USD 7,300 to over USD 24,500. These high costs are fixed by rigid contractual terms. In summary, the ROI of GovSpend is a high-risk, high-reward proposition. There is the potential for substantial returns, but also the concrete risk of negative returns.

GovSpend: The Scores

| Category | Score | Summary |

|---|---|---|

| Ease of Use & Interface | 9.5 / 10 | The platform’s greatest strength. It is modern, intuitive, and consistently praised as a significant improvement over complex competitor UIs. |

| Data Quality & Actionability | 5.0 / 10 | A critical weakness. While the data aggregation is vast, recurring user complaints about outdated contacts and a lack of tangible leads severely impact its value. |

| Value for Money (TCO) | 6.0 / 10 | The high, opaque pricing and rigid contracts create a challenging value proposition. The ROI is highly inconsistent, making it a risky investment. |

| Partnership & Support | 4.5 / 10 | Deeply polarized user feedback and customer-unfriendly contract terms point to a transactional, rather than partnership-oriented, relationship model. |

Alternatives to Consider

- Deltek GovWin IQ: The established market leader, particularly in the federal space. Perceived as having more comprehensive data and better support, but with a more complex and less intuitive user interface. Use code 25GOV for a free trial.

- Starbridge.io: A newer, AI-focused platform known for its forward-looking intelligence, aiming to identify opportunities before an RFP is even written. A strong choice for teams prioritizing early-stage business development.

- HigherGov / EZGovOpps: Other significant players in the market, offering competitive feature sets that warrant evaluation in any head-to-head comparison.

The Final Verdict: Who Should (and Shouldn’t) Buy GovSpend?

After a comprehensive analysis, our final verdict on GovSpend is nuanced and comes with significant caveats. It is not a one-size-fits-all solution, and its value depends entirely on the profile of the buyer.

For SLED-Focused Commercial Vendors: Conditionally Recommended

If your primary market is state, local government and education, GovSpend is a sensible, if expensive, option. The intuitive interface and unique data on “hidden” discretionary spending are compelling. However, before you sign a contract, you must: 1) Aggressively negotiate on price and have all automatic renewal clauses removed. 2) Insist on a short-term paid pilot project to verify data quality for your industry and territory.

For Federal-Focused Commercial Vendors: Caution Advised

With the Fedmine platform, GovSpend has a seat at the federal table, but it is not the market leader. It should be considered as a potential alternative to Deltek GovWin IQ, but only after a thorough, straightforward evaluation has determined that its data and capabilities are sufficient for your needs.

For Government Agencies (Federal, State, or Local): Not Recommended

The platform is not a suitable procurement solution for the public sector. The complete and verifiable lack of essential security and accessibility certifications poses an unacceptable compliance and cybersecurity risk. Until GovSpend can independently demonstrate compliance with regulations such as FedRAMP, StateRAMP, and Section 508, it should not be considered for procurement by any government agency.

To summarize, GovSpend is a platform with profound contradictions. It combines a first-class user interface with questionable data quality. It is backed by a stable, well-funded ownership group that enforces customer-unfriendly terms and conditions. It offers the potential for a high ROI, but also carries the risk of not achieving it. It is a powerful tool, but it requires extreme care, aggressive negotiation, and a clear understanding of the significant risks involved. Buyer, be aware.

References

- Thompson Street Capital Partners — acquisition notice for GovSpend (Jan 2021).

- GovSpend acquires Fedmine — businesswire / company releases (Aug 2021).

- G2 product and user reviews — high ease-of-use scores and mixed data-quality feedback.

- Vendr / procurement marketplace snapshots — median contract values around $10K/year (range $7.3K–$24.5K).

- FedRAMP marketplace & program documentation — explains federal authorization requirements and marketplace listings. (No FedRAMP listing found for GovSpend in the public marketplace.)